Derick Hudson

Meta Platforms (“Facebook”, “Meta”, “FB”) (NASDAQ:META) has been a perennial underperformer for the past few years relative to other mega-caps, largely due to headwinds and deceleration trends in its existing business (mainly legacy Facebook), but also due to self-inflicted wounds from a spending binge that hasn’t been seen relative to its size, perhaps, ever.

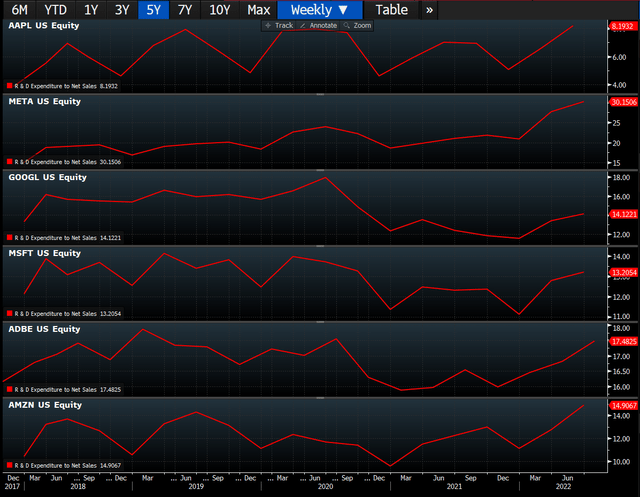

Meta Platforms’ operating expenses plus the cost of revenue, are eclipsing almost $80B for a company that runs a handful of Apps and an emerging virtual reality platform. If one viewed Meta through the lens of a private equity takeout, one could easily arrive at a valuation of 2x today’s price after widespread cost cuts and stock buybacks. For instance, R&D as a percentage of LTM sales hovers around an astonishing 26%, and in the most recent quarter was above 30%. Relative to other sub-scale social media names such as Snap (SNAP) and Pinterest (PINS), this may not appear that high, but when comparing it to larger scaled mega-cap names, it stands out as extraordinarily high. In fact, Meta spends almost 20% more in R&D than the largest publicly traded technology company in the world, Apple (AAPL).

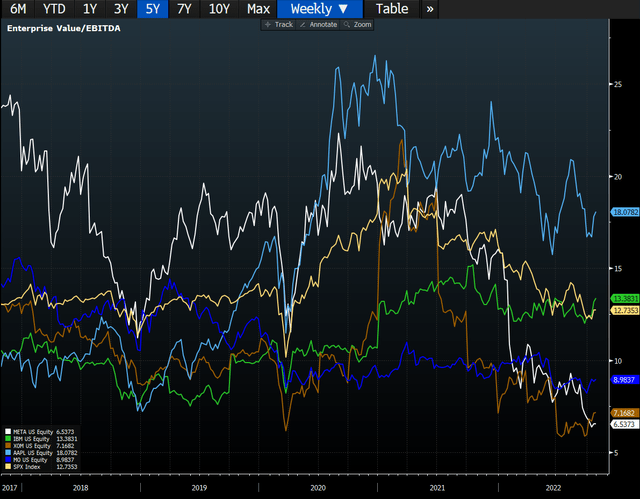

While many analysts are quick to point out that Meta needs this level of spending to support future growth and retain its longer-term viability, we think that the market has priced in a dire scenario- one of a consistent secular decline. What has been priced into Meta is spectacular; the market is pricing in a complete Yahoo-style implosion of the business. So much so, that Meta is trading at an alarmingly low valuation (6.5x LTM EV/EBITDA), so penalizing that it is now significantly below tobacco company valuations, and only a slight premium to Exxon Mobil (XOM) on an LTM EV/EBITDA basis. At below 7x EV/EBITDA, we think investors are getting decent downside protection with an asymmetrical upside if just a few factors go right for Meta. We think Meta is in a position to manufacture almost whatever profitability they want; historically, this has been a very lean business, producing at peak 87% gross margins, and 57% adj. EBITDA margins. Zuckerberg has been on such a Capex & R&D spending binge that current FY consensus ’22 free cash flow looks about like it did in 2017, with over 2x+ the adj. EBITDA and triple the sales of FY 2017. The strategic plan from Meta was to invest heavily in Reality Labs, and at the same time embark on a hiring binge that has dampened margins and compressed FCF per share.

Furthermore, there is significant noise around macro weakness; it is becoming quite evident that advertising weakness has hit virtually all digital advertising. While Covid was a boom for any company involved in digital advertising, there is also a hangover effect from such rapid growth, and we think the market is pricing in significant future earnings impairments and a continual and rapid secular decline (consistent bear thesis) in the entire business - something we just don’t see when looking at DAU/MAUs or sales trends of the overall business. While there is geographic weakness in certain areas (mainly pertaining to Facebook NA), when viewed as a family of apps, the overall growth trajectory is still positive. Additionally, the largest communication App on the planet, WhatsApp, is still vastly under monetized; but we are just starting to see some hints at monetization with payments taking off in India and business ads running. WhatsApp has grown tremendously from 450m users when acquired to 2.44B users today; on top of this, Instagram is showing continued growth, and Facebook has a stickiness to its platform that many social media platforms do not with FB Marketplace, Messenger, Groups, etc.

The long-term trends still seem favorable even if at significantly lower growth rates or even flattish growth indefinitely, as long as costs come down in a meaningful manner. Since 2019, the company has grown sales by over +65%, adj. EBITDA by +64%, and net income by +58%, all while more than doubling Capex since 2019. To us, this is not a full fledge complete turnaround of a business, but more of a business pivot and a spending problem, even with consideration from Apple’s IDFA policies. In the last few months, Zuckerberg has been publicly changing his stance on costs and headcount; we think if Reality Labs gets downsized to some extent in the quarter, it would be viewed as a huge positive.

What Has Changed Recently?

We think a big change in the underlying business that has gone unnoticed by many is Zuckerberg is finally considering a rightsizing of the workforce, potentially culling 12,000 underperforming workers, or around 15% of the total staff. He met with staff in late September to discuss wide-ranging steps that would be taken to reduce costs. Reportedly, Meta is looking to “cut costs by at least 10 percent in the coming months”. Some of these cost initiatives will result in the company ending its lease at 225 Park Avenue in the Flatiron district, which is roughly 200,000 sq. feet. Also, a 300,000 sq foot expansion plan of the company’s 770 Broadway office was abandoned this summer. Anecdotally, based on a few employee conversations, “anything that isn’t bolted down” is looking to be sold or maximized for efficiency - this includes employee travel, expenses, food/entertainment etc. It also appears from a few sources that Meta might be actively cutting jobs, rather than “culling” individuals to streamline the business for the current economic backdrop and slowing digital ad spending.

Meta has lowered its 2022 expense outlook in the most recent quarter from $87B-$92B to $85B-$88B, or by $3B at the midpoint. This represents the 3rd straight quarter in which Meta has trimmed its expense outlook from the original $91B-$97B, for an 8% cumulative reduction at the midpoint. While details have emerged over the past couple of months on Meta’s cost-cutting initiatives, a larger, more comprehensive re-rating in the cost structure appears at hand and likely at Reality Labs as well.

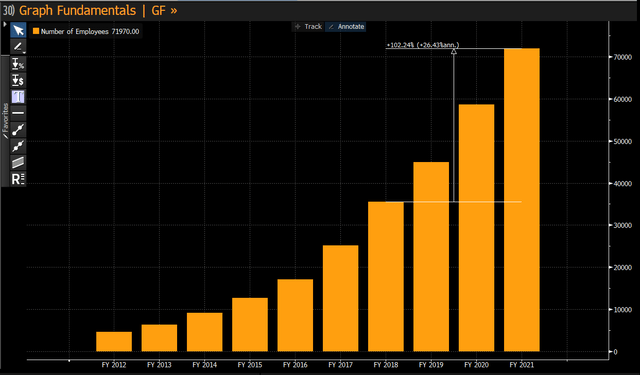

Number of total employees (Bloomberg)

*Source: Bloomberg

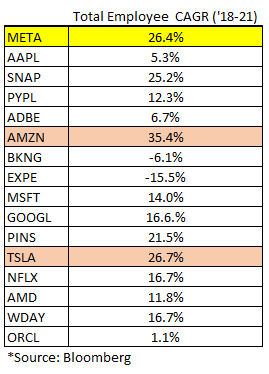

Since FY 2018, Meta has increased its employee headcount by over +102%, sales approximately +114%, and EBITDA up ~ +70%, all while the stock price is, on average, down since 2018. One would think that running a handful of apps would have significant fixed cost leverage over time, but it has become apparent that costs/jobs have gone up materially faster than topline revenue growth—in fact, during the ’18-21 fiscal years, SG&A costs went up over 134%, with R&D cost up a massive 190%. To gain some perspective on what other companies have done over the past four years, out of the mega-cap stocks $500B and above, only Amazon (AMZN) and Tesla (TSLA) have had bigger increases in total employee growth. Both Tesla and Amazon also just happen to be the most capital-intensive businesses, in comparison. For instance, Tesla has opened three large factories in Shanghai, Berlin, and Austin, Texas just in the past few years, while Amazon’s employee growth has largely been centered around growth in its retail business and corresponding warehouse growth.

Total Employee CAGR (Bloomberg)

The prior reason for the higher gross number of total workers was due to a large quality control effort after the Cambridge Analytica scandal. Since then, most of the quality control has been performed by AI algorithms that pick up questionable content that is posted on the platform and remove it. There have also recently been some ambitious plans for aggressive hiring for the ‘metaverse’; but recently, Zuckerberg has even slowed that endeavor by reducing new engineer hires by roughly 30%.

While there is an argument that all this investment is needed to support the growth of the business and the next generation of VR/AR, other turnarounds/business pivots didn’t require anywhere near this level of investment. Microsoft’s (MSFT) early cloud growth acceleration from 2013-2016 only saw an employee growth CAGR of 4.8%, with R&D up a similar amount. In the last twelve months, Facebook has spent almost $5 billion more in aggregate on R&D than the largest tech company in the world, Apple. To say the R&D spending is outpaced is the understatement of the year; Meta is spending more than Apple, a company with a market cap almost 7x the size of Meta. Meta is spending greater than 30% of net sales on R&D in the most recently reported quarter, a massive number by any standard. For example, over the last 12 months, Amazon has spent less than 13% of total sales- Microsoft ~ 12%, Google ~ 12.7%, Adobe at 16.7%, and Apple at 6.5%. On average, of the mega-cap tech names, Meta Platforms is spending almost 2x+ the R&D dollars per unit of sales. To us, this seems like an area ripe for efficiency gains; we understand that Zuckerberg is attempting to speed up innovation, but this seems so extreme, even if one believes that the core business is in decline. While the comparison is not necessarily apples-to-apple, across the mega-cap space there is a glaring inefficiency problem at Meta. The output of the business (profitability & topline growth) is not even closely related to the amount of R&D being spent on an annual basis.

R&D Expense per Sales (Bloomberg)

*Source: Bloomberg

Macro Headwinds

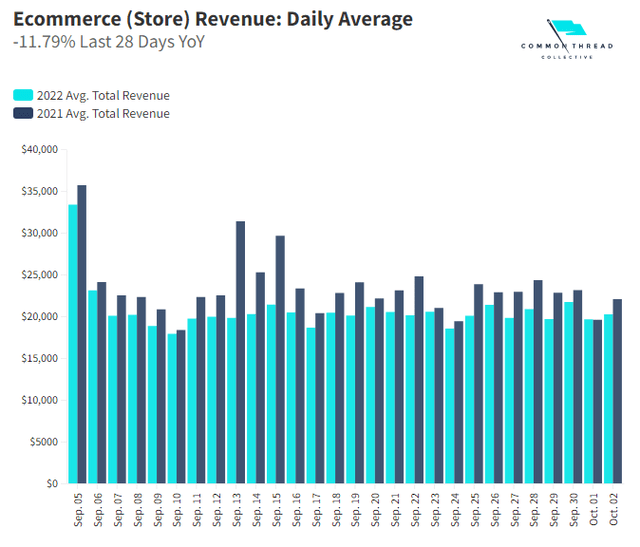

We haven’t really seen how a social media advertising business holds up in a recession, but it looks like we are going to get a chance to witness that outcome over the next 6-12 months. During other past downturns, online advertising has held up surprisingly well, versus legacy forms of advertising. It is clear there is a widespread slowdown in E-commerce, legacy advertising, and a significant deceleration in digital advertising.

E-Commerce Revenue (Common Thread)

The combination of IDFA headwinds, a post-pandemic slowdown, and what is now looking like a full-blown recession, has been putting pressure on Meta’s business. Over the past quarter, Meta’s advertising revenue grew +3% (currency adjusted) over 2021 and is up +70% since 2019 prior to the pandemic. Another metric “daily active people” or DAP is up 35% since the 2019 period, and advertising partners are up to 10 million from 8 million pre-pandemic. Despite all these impressive feats, the stock is at 2018 levels and priced as if it is in a terminal decline. While it is hard to tell exactly how much the business has “decelerated” from the pull-forward in demand for advertising from the pandemic boom, what’s clear is that Meta is priced for a structural impairment of the business longer-term. While there has been a lot of recent skepticism from analysts, given Meta’s most recent Q2 ’22 was the first ever Y/Y decline in advertising revenue, we think there are a few multiplicative events that have optically made it appear worse than it is. First, the massive pull-forward in digital advertising due to the pandemic, likely took significant growth from the next handful of quarters; on top of this, the IDFA headwinds impacting the business, significant FX headwinds, Russia’s ban of Facebook and Instagram at the end of Q1 ’22, and some cannibalization from Meta’s focus on Instagram Reels and the overall lower monetization all made an impact. All these recent trends have created a so-called “perfect storm” for Meta- one that we think is largely temporary in nature and should be mitigated over time.

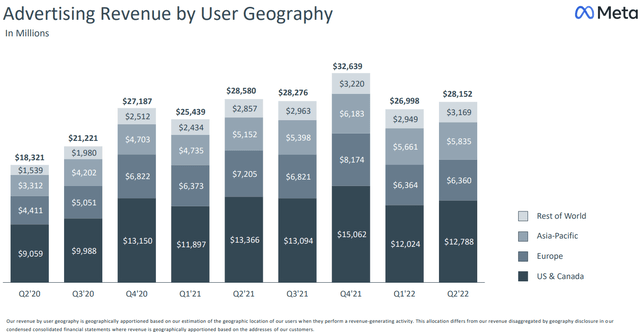

Advertising Revenue (Meta Platforms)

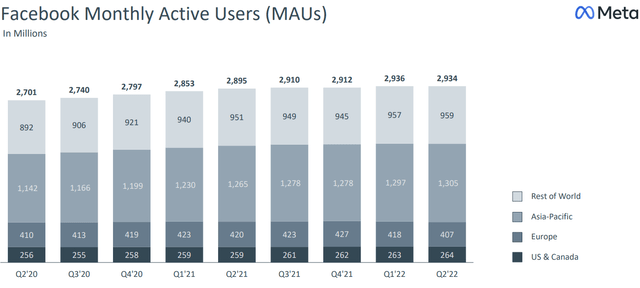

While Meta’s Q2’ 22 Y/Y growth is clearly far from perfect, the monthly active users tell perhaps a better story; overall Q2’ Y/Y was up about +135 bps in one of its most challenging quarters ever. Even the higher margin and slower growth geographic markets of U.S. & Canada were up Y/Y.

Facebook MAUs (Meta Platforms)

Lapping IDFA Becoming Easier For Meta

Last year, Meta's y/y rev growth fell by ~ 2,000 basis points q/q (from 56% in 2Q21 to 35% in 3Q21) with a significant portion of that owing to Apple's iOS privacy changes. This year, growth should have “re-accelerated” to some extent for Meta in 3Q and 4Q ‘22 as it lapped the IDFA disruption. While there are macro headwinds and economic considerations, the difficult comps from the initial shock of IDFA should abate, given the lapping starting in Q3 ’22.

Even with all the aforementioned significant headwinds to the business, CPMs have actually held-up very well and even grown in the face of these challenges.

Average Facebook CPM (Cost per 1k impressions)

- Facebook CPMs 2020–21: $12.05

- Facebook CPMs 2021–22: $14.04

- Facebook CPMs YoY %-change: +16.54%

iOS 14.5 Effect on Facebook CPMs

- Pre-iOS CPMs (Feb.–Apr. 2021): $11.55

- Post-iOS CPMs (July–Sept. 2021): $12.29

- Pre vs Post CPMs %-change: +6.44%

The company mentioned that although Apple's IDFA changes remained a headwind in Q2, it did not contribute to the sequential deceleration, and Q3 should benefit from the tailwind created by IDFA implementation lapping. This will be the first quarter of the IDFA lapping, and investors will get to see if advertisers continue to flock towards single digital advertising platforms.

Deutsche Bank Note:

IDFA and Privacy Mitigation

“Meta highlighted the performance and continued adoption of Conversions API ('CAPI') and CAPI Gateway and mentioned that they continue to roll out solutions that help maximize advertisers' ROI while leveraging the company's AI capabilities. Most recently, Meta introduced "Meta Advantage", a suite of advertising tools designed to help automate and optimize ad campaigns, including automatic audience targeting feature called "Advantage Lookalike" which helps to improve campaign performance by using Meta's AI/ML capabilities to deliver ads to people outside defined lookalike audience if it's likely to improve performance. We think, these solutions will continue to attract and retain advertisers onto Meta's properties, but highlight risks associated with the company's greater exposure to SMBs, who could be slower to adapt to these new solutions.” Benjamin Black, July 2022

Valuation

EV/EBITDA Comps (Bloomberg)

*Source: Bloomberg

While we can debate the right multiple for Meta Platforms, we don’t think it should be priced like a secularly challenged IBM (IBM) that has been a perennial market share donor. We think viewing Meta on an LTM basis gives a decent view from what we think Meta Platforms can produce in a more normalized expense timeframe, even if adjusted EBITDA margins remain near trough levels. Overall, we think Meta has indeed become more of a sustainable blue-chip company, with a slower topline growth trajectory than in the early years. Sell-side analysts have recently lowered consensus estimates, but still have Meta growing topline at a very respectable average of 9.63% for the next four years, which is significantly faster than the overall market. If Meta’s multiple were to just get back to an S&P 500 multiple, the stock price would be double from here - not to mention if Zuckerberg aggressively does an accretive buyback at these trough levels. If Meta were to get back to prior EV/EBITDA multiples in mid-2021 (roughly the multiple Apple is trading at now), the stock could triple. By the end of Q3 ’22, Meta should be sitting on roughly a $27B net cash position - something that we think should be put to work with a large-scale buyback in combination with an aggressive cost-cutting plan.

We think, as the market gets more comfortable around challenges with IDFA, TikTok, and the overall economic malaise, that the re-rating on Meta’s shares could be equally dramatic as it was on the way down. Using history as a guide, Facebook has managed to successfully navigate many comparable challenges in the past, including the massive business pivot during its IPO days of switching from desktop to mobile monetization. While these recent challenges are unique, Zuckerberg and his team give us confidence they can steer the company successfully through the current set of headwinds.

Prior Skepticism & Future Growth

Headline (Telegram)

“Two clear cases of wild and crazy tech valuations…. The 2-year-old startup (Instagram) had no revenue, no profit and 13 employees, yet Facebook bought it for $1 billion” – NY Post April 15th 2012

“On balance, I’m not sure it’s the best way to do business (referencing the Instagram purchase),” said Ali Velshi, CNN’s chief business correspondent. “But Mark Zuckerberg has defied all rules.” – CNN April 2012

“Facebook's $1 billion acquisition of Instagram, a photo sharing app that costs zero dollars to use and has no source of revenue, sure feels like a social networking tech bubble.” – The Atlantic April 2012

At the time, Instagram was thought to be a business that was not really monetizable to the extent that Facebook was, with zero revenue and around 50 million users; the thought from most skeptics was that Instagram was a hedge to the larger Facebook platform. In the end, Instagram ended up becoming hugely successful, now producing over $20 billion in high margin revenue that continues to grow globally at a very healthy clip.

While the success of Instagram has been easy to observe over the years, WhatsApp is more of a mystery. Facebook acquired WhatsApp in 2014 for $19 billion, with approximately 450 million users at the time. Over the years, Facebook has invested substantially in WhatsApp to improve the user experience and increase the overall number of users globally. As of April 2022, WhatsApp had approximately 2.44 billion users worldwide, or 5.40x the number of users it did when Facebook acquired the business in 2014. While monetization has been minimal, Meta is attempting a trial payments solution in India after getting regulatory approval for 100 million users—not a small feat.

It took Google Pay approximately 3 years to reach 70 million users in India, and it seems that WhatsApp, with its 400m + Indian user base, has a significant advantage over competition in this market. The ease of interaction made available by WhatsApp Payments is certainly a feature worth exploring for Indian users, especially if the brand is relying on social selling. While this is in early development for WhatsApp, there is potential to see WhatsApp becoming a payment solution for other countries, with India becoming the payment standard. Moreover, this further increases the future viability of a “super app” that features social, message, communication, selling, gaming, and payments.

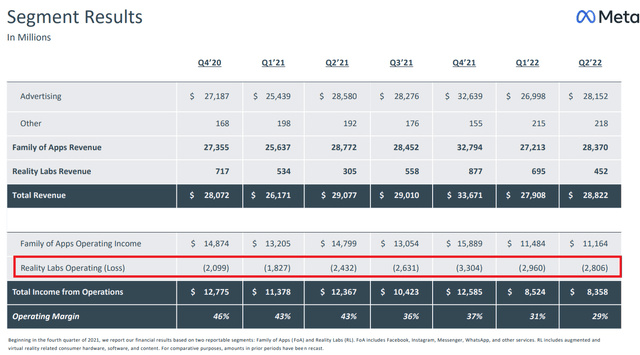

Reality Labs (VR & Augmented Reality)

Segment Results (Meta Platforms)

In the last 7 quarters, Reality Labs has incurred over $18B+ in operating losses; given the recent cost-cutting initiatives, we think that the trajectory of investment into Reality Labs is likely to slow. In our view, the market wants to see Reality Labs as a division for future investment, but not a singular bet. While many think there is limited viability for VR/AR and the Metaverse, we certainly think that the future is moving in that direction. As technology improves with Micro OLED and very higher refresh rates, we think virtual reality is going to have significant breakthroughs to encourage wider adoption rates and higher remote workplace productivity.

While the metaverse is still solidly in its infancy, there are encouraging signs that adoption might be picking up quickly. Some of the biggest music artists have been dedicating significant resources and energy to metaverse shows recently; these artists include Marshmello, Travis Scott (130m+ views), Foo Fighters, Justin Bieber, David Guetta, Ariana Grande and Post Malone. The ease of putting on a virtual concert along with other artists likely generating more money virtually for less time, makes a lot of sense to many big names in music. It was rumored that Travis Scott earned $20 million from the virtual concert on Fortnite, and Ariana Grande earned in the high seven figures as well.

“…Virtual concerts are desirable from the artist’s perspective because they do not require travel and the number of viewers is not limited by venue size. There is naturally also an economic driver, as virtual venues do not demand the same amount of stagehands, security or other costly infrastructure, and also because the number of middlemen is reduced.

With the view that different scheduled events are happening in various virtual worlds, the idea of the Metaverse as a reality consisting of numerous intertwined virtual worlds is becoming increasingly current.” – Cointelegraph

There are wide ranging applications for education, on the job training, workplace applications, virtual meeting Apps that make remote work meetings appear almost life like. While it will likely take some big App hits and some technology breakthroughs to increase mass adoption, we believe it will eventually happen, as some of the problems that VR has faced in the past have been improved upon and solved. It is estimated that Meta, with its Quest headsets, has approximately 90% of the burgeoning high growth VR market. If Zuckerberg can have ownership of the next big hardware platform, we think investors will begin to reassess his strategy and begin valuing Reality Labs for its future growth aspirations, rather than deeming it a cost center.

Meta VR Day Overview (Meta Platforms)

If one assumes that the Quest Store revenue measurement periods were from the end of February until the end of September, it appears that in approximately seven months, VR game and software titles are running at an annualized growth rate of well over 85%+ and likely close to $1B revenue run-rate, if including the significant holiday sales in Q4. It seems that this razor & blade model is starting to work with accelerated adoption and usage over the past seven months, as developers buy into producing content on the Quest Store. This high margin revenue represents a small portion of Meta’s total annual revenues but is growing exponentially; if one just assumes a more normalized level of Store growth of, say, 50% per year for the next four years, one could easily envision annual high margin Quest Store sales of over $5B – with greater than a 30% take-rate on that revenue. In our conversations with many in the field, numerous engineers believe that with the next technical iterations of Quest that solve a few fundamental issues (vertigo, refresh rates, graphics etc.), we will see a stepwise function in increased adoption that will likely accelerate usage and purchases on the Quest App Store.

Future Catalysts

- The market begins to appreciate the staying power of the Facebook family of Apps and consistent and steady longer-term growth with the overall digital advertising market.

- Aggressive cost cuts enhancing the overall efficiency & margin profile of the business—likely in the form of a total headcount reduction in the 10-20% range.

- Reels monetization success and engagement helping to thwart competitive threats from TikTok.

- A large aggressive buyback at these trough multiples.

- Quest App Store holiday sales growth with the release of numerous blockbuster titles.

- TikTok gets a U.S. ban, while likely a fairly low probability, in a recent report by Forbes it was indicated that ByteDance’s Internal Audit team was planning to use location information to surveil individual American Citizens, not to target ads. This was reportedly targeting members of the U.S. Government, activists, public figures, and journalists.

Final Thoughts

We believe Meta’s dominant ownership of social media advertising, strong competitive positioning, and focus on the user experience, position it to become an enduring blue-chip company built for the long term. Meta has a unique combination of scale, growth, and profitability, as the company’s massive reach and engagement continue to drive network effects, and its targeting abilities provide significant value to advertisers. While Meta clearly has near-term issues with a tough macro backdrop, FX headwinds, TikTok competition, and the Apple IDFA changes, we think these challenges are surmountable longer-term. What is implied by Meta’s stock price is a secularly challenged business model that fits a narrative of flattish future growth and continual margin pressures, akin to an IBM or Tobacco stock. With just a few future catalysts evolving, we think that the market’s perception of Meta might drastically change as costs come under control, IDFA fixes become more apparent, and Reels success helps maintain engagement and monetization trends on Instagram. We think at these trough multiples, the asymmetric upside of Meta’s stock is vastly underappreciated by the sell-side community and investors.

This article was written by

Join for free account log in straight. Discover the growing collection of high quality most relevant xxx movies and clips. She takes you to her room and she told you to lay your head.

CDM Capital is currently an allocator for institutional capital looking to invest in U.S. and European equity markets through top-tier hedge funds and alternative investments. CDM Capital’s most recent experience was as a PM for a single family office, prior to that was a generalist analyst covering U.S. and European equities. CDM Capital has been ranked a top 30 buy-side analyst by Sumzero based on performance (as of 11/20/20) with an overall annualized return of 43.2%.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.